Yes, please!

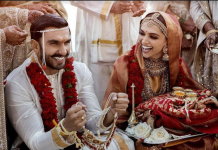

With the ever-rising costs of the wedding trousseau, and jewelry, and decor, and venue, and mehndi, and and and! Financing a wedding that costs that much or more can be daunting, even if your parents are covering some of the costs – and when the honeymoon is over, you could find yourself facing a mountain of debt. Or you could plan now to avoid long-term wedding debt later by following these basic financial principles so keep your heads above water.

Be romantic and realistic. A wedding lasts a day, the rest of your life lasts much longer so think of your wedding as part of your overall financial life. Decide what will make both of you happy within a reasonable, affordable budget.

Don’t pay with plastic. Pay for your wedding with money you’ve saved, not with a credit card or by “borrowing” money from your investments or retirement fund, or you’ll end up paying for your wedding for years. Let’s put this into perspective: if you use your credit card for $25,000 in wedding expenses, at a 14% annual interest rate and only make the minimum payment each month, you’ll make your final payment on your 45th anniversary.

Be strong and plan on. Use the wedding budget process as a learning exercise for you, as a couple to work together toward your common financial goals. Here are some simple questions for you to answer to get you going to building a “couples” budget:

How much debt is each of us bringing to our marriage?

How much money have we saved so far?

What is our combined monthly income (salary and other income)?

What are our monthly costs?

How much can we afford to put into our wedding fund each month?

How much can we afford to save/invest to achieve our other “dreams”?

Tighten the financial ‘nuts ‘n bolts’ of your relationship. Be honest with each other about your debts and assets and consider a prenuptial agreement. After the wedding, be sure to review beneficiary designations on insurance policies and registered investments, draft a new will, and take full advantage of all spousal benefits on your tax returns,

Yes, with some smart financial planning – and perhaps the help of your professional advisor – you can realize your wedding dreams and live a happy financial future together.

By: Aimee Sehwoerer